Amidst the media storm and calls for investigation swirling around Mylan regarding the price of their EpiPen® epinephrine auto-injector, the company issued a press release outlining a series of consumer facing initiatives to make the device more affordable.

In case you missed it, here are the four initiatives gleaned from the press release that Mylan has committed to so far, along with the relevant links and comments.

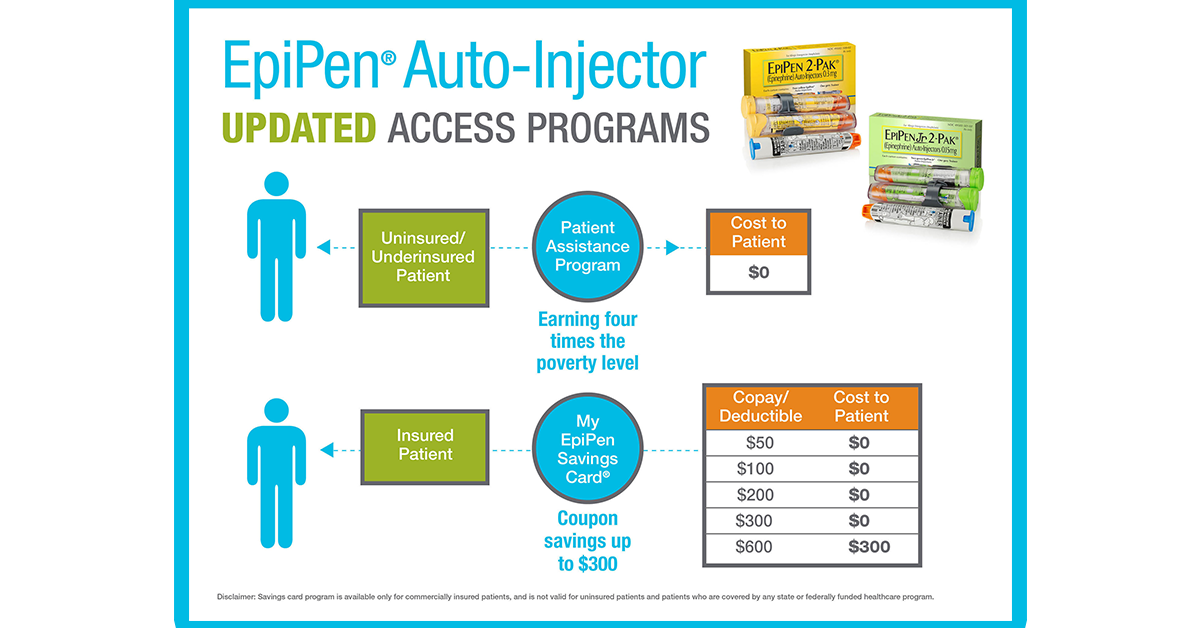

- The company will immediately offer a savings card for up to $300 that will reduce out of pocket expenses by 50%. This benefit is only for people with prescription coverage. You can learn more about eligibility and apply for this card by clicking here.

- The company will raise eligibility for their patient assistance program to 400% of the federal poverty level. As an example, a family of four making up to $97,200 will pay nothing out of pocket for their EpiPen auto-injectors. You can apply for this benefit by clicking here.

- The company will continue its EpiPen4Schools® program which provides free, stock EpiPens. Make sure your child’s school participates in the program. Schools can apply by clicking here.

- Mylan will provide a means to order EpiPens directly from the company, further reducing the cost. We will provide more information on this new capability as it becomes available from the company.

The hope is that these steps will move us closer to the ideal of every single person in need of epinephrine auto-injectors being able to afford them.

What the press release did not address is how the cost of the device will change for insurers. This has an indirect effect on the subsequent cost of healthcare insurance acquired via employers, directly, or via the exchanges established under the Patient Protection and Affordable Care Act (ACA or “Obama Care”.) We will report on this aspect once we have more information.

I would still like to know why they are $100 in Canada per pen.

So basically I should drop my insurance because I will get it for free? Awesome. Can i quit my job to and you can pay for other things too..phone? food? housing?…oh, right, the government will do that…no, that doesn’t come from my paycheck by any means…I’m sick of the working people still having to pay while those who stay home get everything handed to them. I’m grateful for the reduction, but EVERYONE should get an equal reduction. You are supporting and encouraging people to remain without healthcare coverage and that RAISES prices for those of us with insurance in the long run. Simple math…someone has to pay for it folks.

Still not enough. It should cost little more than it does to make for something like this. What does it cost to make? Double it. That is more than enough.

Easy, there, Allergy Mom. Here’s our scenario: 2 local insurers do almost all the business here. It’s a duopoly. My job doesn’t provide insurance, so I’m on my own. The insurance I bought covers practically nothing and still costs $6000 a year, with an insanely high deductible. It’s basically catastrophic insurance.

What adds insult to injury: one member of the duopoly – hi there, UPMC! – uses its contracts to force some independents not to deal with me, *even on a cash basis*. This is an attempt to force its customers to use UPMC facilities. Why wouldn’t we? For the test in question, it costs *less* to pay the independent out of pocket than the *co-pay* at UPMC. So by having UPMC insurance, I actually lose a lot of my freedom. This is, of course, “disclosed” in ways that you’re not supposed to figure out until you’ve signed up – at which point you’re not permitted to switch again until the beginning of the following year.

I work in healthcare and I used to think that anyone who was voluntarily uninsured was either Amish, broke, or playing the odds. I don’t think that at all anymore, and I can see why someone with this UPMC insurance would simply quit paying for it and hope for the best. It’s a scam.